Your Life, Your Family, Your Home, Your Bank - It All Starts with You

Our personal banking options are designed to meet your individual needs, so you can choose the services and products that are right for you. Enjoy the ease and conveniences such as our debit cards, online banking, and mobile banking, so you can spend more time with the people and activities that matter most.

| Money Market | NOW Account | Regular Checking | Statement Savings | Christmas Club | |

|---|---|---|---|---|---|

| Interest Bearing | Yes | Yes | No | Yes | Yes |

| ShazamChek ATM/Debit Card | No | Yes - Fees may apply if using ATM not owned by the Bank | Yes- Fees may apply if using ATM not owned by the Bank | No | No |

| Minimum opening balance | $1,000 | $100 | $100 | $100 | $100 |

| Maximum monthly transaction | 6 transactions per statement cycle $10 per transaction over limit | 10 transactions per statement cycle .10 per transaction over limit | Unlimited | 6 transactions per statement cycle | 6 transactions per statement cycle |

| Monthly service fee | $10 Exemptions to this fee include: Individuals over 60 years of age, minors/full time students, and military personnel. To be eligible for this exemption customers need to notify the Bank. | $3 Exemptions to this fee include: Individuals over 60 years of age, minors/full time students, and military personnel. To be eligible for this exemption customers need to notify the Bank. | $3 Exemptions to this fee include: Individuals over 60 years of age, minors/full time students, and military personnel. To be eligible for this exemption customers need to notify the Bank. | $3 Exemptions to this fee include: Individuals over 60 years of age, minors/full time students, and military personnel. To be eligible for this exemption customers need to notify the Bank. | N/A |

| Minimum balance to avoid fees | $1,000 Daily | $300 Daily | $300 Daily | $100 Daily | N/A |

| Internet Banking/Mobile Deposit | Yes | Yes | Yes | Yes | Yes |

| Bill Pay - Free 3 Month trial | Yes - $5.95 Monthly | Yes - $5.95 Monthly | Yes - $5.95 Monthly | Yes - $5.95 Monthly | No |

| Other features | A variable tiered interest rate. The higher the balance the higher the interest rate. | Annually at the end of the club account period, the funds will be mailed to customer by check. |

Consumer Checking Account Features

- $100 minimum to open

- Free withdrawals at ATMs located at the Bank of Bluffs and Meredosia Community Bank

- Paper Statements (1 free statement per statement cycle)

- Internet Banking

- Bill Pay ($5.95 monthly)

- ShazamChek Master Card Debit Card

- Checks

- Insured up to FDIC deposit limits

Fees:

$3.00 per month if daily balance falls below $300 per statement cycle (N/A to exempt customers)

$1.00 per withdrawal at ATM’s we do not own or operate.

Now Account Features

- $100 minimum to open

- Interest Bearing

- Free withdrawals at ATMs located at the Bank of Bluffs and Meredosia Community Bank

- ShazamChek MasterCard debit card

- Paper statements (1 free statement per statement cycle)

- Internet Banking

- Bill Pay ($5.95 per month)

- Checks

- Insured up to FDIC deposit limits

Fees:

$3.00 per month if daily balance falls below $300 per statement cycle

.10 Per transaction if debits exceed 10 per statement cycle (N/A to exempt customers).

$1.00 per withdrawal at ATM’s we do not own or operate.

Consumer Money Market

- $1,000 minimum to open

- Interest Bearing – Tiered rate structure

- 6 Debits Per Statement Cycle (excludes in house withdrawals or transfers)

- Internet Banking

- Paper Statements (1 free statement per statement cycle)

- Bill Pay ($5.95 monthly)

- Checks

- Insured up to FDIC deposit limits

Fees:

$10.00 per month if daily balance falls below $1,000 per statement cycle

$10.00 per transaction if debits exceed 6 per statement cycle (excludes in house withdrawals or transfers)

Statement Savings

- $100 minimum to open

- Interest Bearing

- 6 Debits Per statement cycle (excludes in house withdrawal or transfers)

- Paper Statements (1 free statement per statement cycle)

- Internet Banking

- Bill Pay ($5.95 monthly)

- Insured up to FDIC deposit limits

Fees:

$3.00 per month if daily balance falls below $100 per statement cycle (N/A to exempt customers)

Christmas Club

- $100 minimum to open

- Annually at the end of the club account period, the funds in the account will be mailed to customer by check.

- Interest Bearing

- Internet Banking

- Insured up to FDIC deposit limits

Fees:

$3.00 per month if daily balance falls below $100 per statement cycle (N/A to exempt customers)

CD/IRA Product

Check with the Bank of Bluffs, (217) 754-3373 or Meredosia Community Bank, (217) 524-1392,

for current interest rates.

Both Traditional and Roth IRA’s are based on the 48 month CD rate.

Insured up to FDIC deposit limits

91 Day, 182 Day, and 1 Year Certificate of Deposit

Terms of CD:

- Penalty for early withdrawal is 1 month interest

- Minimum deposit on CD is $1,000.00

18 Month, 30 Month, and 48 Month Certificate of Deposit

Terms of CD:

- Penalty for early withdrawal is 3 months interest.

- Minimum deposit on CD is $1,000.00

Loans

Click here for our loan calculators

Personal Loans

- We can help dreams come true with a personal loan.

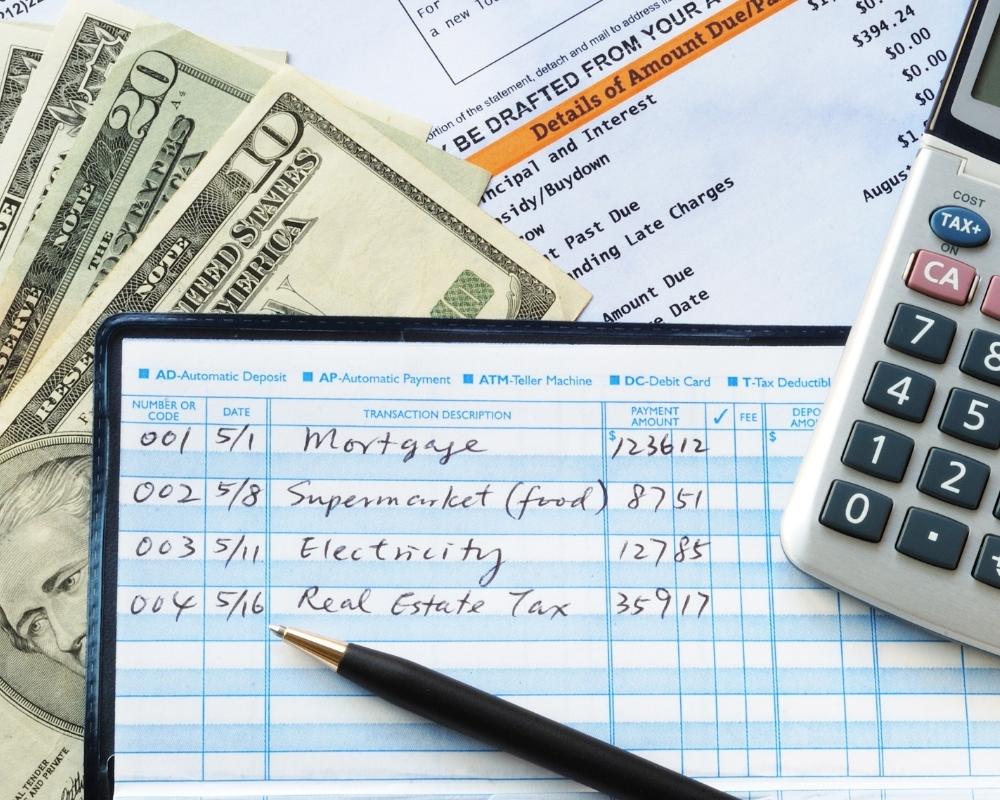

Mortgage Loans

- Whether you’re a first-time home buyer, an experienced homeowner or investor, it’s important to work with a lender you can trust. Bank of Bluffs has the mortgage products, information and expertise you need to plan ahead and navigate the home-buying process with ease, start to finish.

- To expedite your Mortgage Application, we encourage you to gather the following documents:

- 2 years of W-2s

- 2 months of Bank Statements

- 1 month of Pay Stubs

- Copy of Valid Driver’s License

- 2 years of Tax Returns

Call us about your home loan…we’re here to help!

Auto Loans

- Looking to purchase a new or used vehicle? Bank of Bluffs offers fixed rate installment loans. Contact the loan department, today, for rates and additional information.

Safe Deposit Boxes

- Protect your possessions, important documents, collectibles and more, from theft or disaster with a safe deposit box at the Bank of Bluffs or Meredosia Community Bank! Feel secure knowing they are protected in vaulted storage.

- Sizes vary from 1x4x22 ($15.00 yearly) to 9x9x22 ($60.00 yearly) Contact Bank of Bluffs or Meredosia Community Bank today for more information!

- Contents are not insured by the Federal Deposit Insurance Corporation (FDIC).